In recent years, under the influence of social phenomena such as the aging population and young people living alone, people have a new demand for "companionship." Pets are increasingly becoming a source of support for people's emotions and resistance to loneliness. In 2022, China's pet industry, with a market size of 299.1 billion yuan, will become a "golden industry".

Just as every pet owner hopes to be with their pet for a long time, every pet brand and pet industry practitioner also hopes to create more favorable conditions and multiple choices for people and pets to live together in a friendly and harmonious way. Puppylulu, in conjunction with different brands in the pet industry, has gained insights into changes in the concepts of the pet-keeping population and has gained comprehensive insights into the new opportunities and unknown risks behind the booming pet industry, we provide feasibility analysis for the development of the pet industry.

We hope this report can provide informative references for the future development and layout of the client's brand and inject new vitality into the development of the industry. At the same time, we also hope that this report can provide multiple interpretations for pet owners who are concerned about the development of the pet industry and the health of their pets and help pet owners establish a sense of healthy pet ownership to make the relationship between pets and human beings closer and more harmonious and to build a healthier and happier life for pets and human beings.

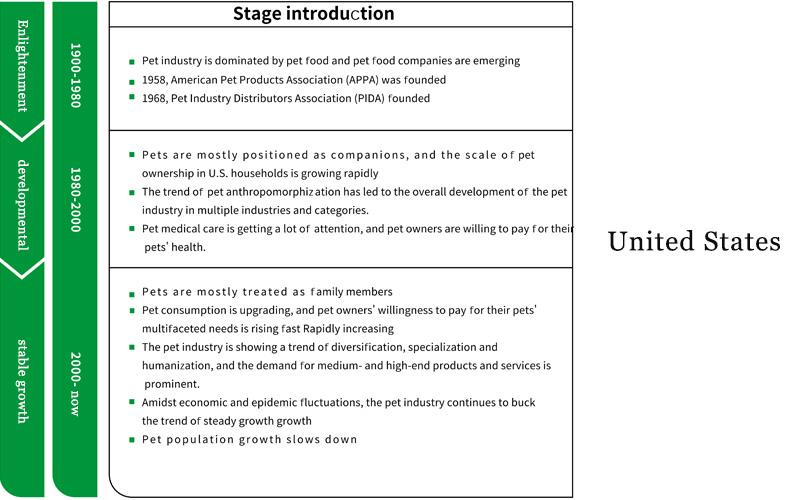

The U.S. pet market is one of the largest pet markets in the world, and "The development history of this can be traced back." back to the early 20th century. In the early days, the U.S. pet industry was dominated by pet food. During this period, two organizations emerged that are still vital to the U.S. pet industry: the American Pet Products Association (APPA) was founded in 1958 as the American Pet Products Manufacturers Association, and the Pet Industry Distributors Association (PIDA) came into being ten years later in 1968.

Over the years, the U.S. pet market has matured into a relatively mature market where pets are treated as family members, and the overall pet industry has become more diverse and specialized.

Pets are primarily positioned as companions, and the scale of U.S. family pet ownership is proliferating.

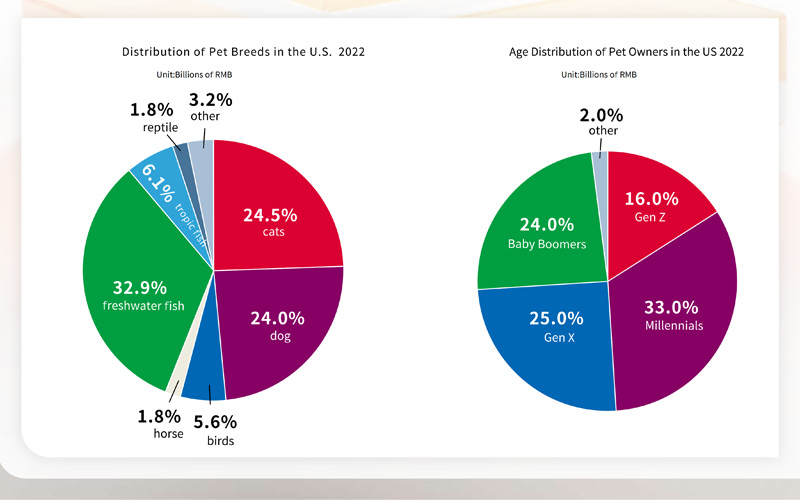

According to Frost & Sullivan statistics and forecasts, the number of pets in the U.S. will be about 402 million in 2022 and is expected to grow at a compound annualized growth rate of 0.3%, reaching 409 million in 2027.

Regarding category structure, freshwater fish accounts for a relatively high share of the U.S. pet market. Cats and dogs are the second and third most significant categories in the U.S. pet market, respectively.

According to an APPA study, Millennials and Generation Z make up nearly half of pet owners in the U.S., with Millennials being the largest group, accounting for 33% of the current pet ownership population, a percentage that has continued to increase over the past few years. Millennial pet owners are increasingly concerned about giving their pets love and special treatment. They view their pets as family members, emotional support, and companions. As a result, they are willing to show their love and care for their pets in various ways, including buying gifts, celebrating their pets' birthdays, and even sharing treats with them.

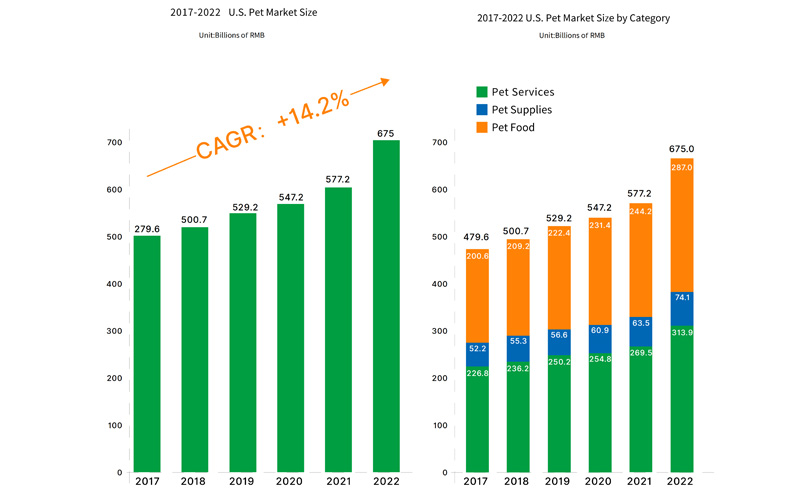

With the growth in the number of pets and pet owners' increasing concern for pet health and welfare, the U.S. pet market continues to grow, with the market size increasing from RMB 479.6 billion in 2017 to RMB 675.0 billion in 2022, rising at a CAGR of 7.1% during the period.

By category, the U.S. pet food market will reach RMB 287 billion in 2022, the fastest-growing category over the past five years, benefiting from pet owners' increasing focus on providing high-quality, nutritious food for their pets and introducing new types of pet food. Pet supply: The pet supply market is the second fastest-growing category, with a market size of RMB 74.1 billion in 2022. The proportion of personalized and intelligent pet supplies is increasing, driving the development of the overall pet supply industry.

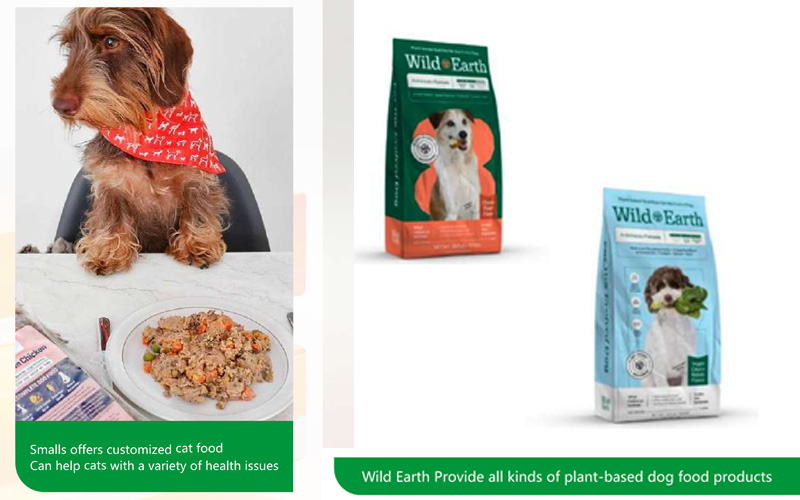

Pet food formulas are becoming increasingly diversified, and most pet food formulas nowadays contain more than 50 ingredients to provide pets with a nutritionally balanced diet. In recent years, with Millennials and Generation Z promoting the concepts of veganism and flexibility, the pet food market in the U.S. has been booming such as Wild Earth, a famous plant-based dog food brand in the U.S., has announced that its revenue growth rate will be more than 700% from 2020 to 2021. The U.S. plant-based pet food industry is growing at a rapid pace.

The U.S. plant-based pet food industry is proliferating, outpacing the traditional pet food industry, and is expected to continue to grow at an even faster rate in the future. Nearly half of consumers have indicated that they choose plant-based pet food ingredients. In addition to the growth in market size, consumer enthusiasm for non-traditional protein sources can also be observed; traditionally, animal proteins such as chicken and bones have been essential ingredients in pet food. However, some North American consumers now believe that plant-based ingredients such as sunflower seeds, quinoa, and algae can provide adequate nutritional intake for pets.

The plant-based pet food craze reflects the development of human vegan culture on the trend of anthropomorphization of pets, which profoundly demonstrates the public's increased emphasis on sustainability, animal welfare, and health, with the recognition of pets as a member of the family.

Customized pet food means that consumers entrust pet food manufacturers specializing in producing customized pet food according to the individual needs of pets, health conditions, preferences, and other factors through the customization of the production of food products suitable for specific pets.

Customized pet food mainly serves the health of pets, with the advantages of fresh ingredients without artificial preservatives, personalized proportioning by professional teams to meet the individual needs of pets, and the elimination of the need for pet owners to regularly purchase additional pet food.

Customized pet food is trendy among young groups. Reviewing the development trend of the U.S. pet industry, the status of pets in the family has gradually increased, and they began to become a member of most U.S. families around 2000. The demand for customized pet food slowly appeared the younger generation's acceptance of this type of consumption was higher, and the business model of customized pet food was verified. For example, NomNomNow, which focuses on customized dog food products, has a scientific team led by a certified pet nutritionist and a Ph.D. and was acquired by Mars in 2022 at a valuation of $1 billion. Similarly, Smalls, which focuses on customized cat food merchandise, recently secured a $10 million Series B funding round.

The pet industry in the Western European market is more mature and at a stage of relatively steady growth. In terms of region, Britain, Germany, and France are the most significant segments of the pet market in Western Europe. According to the statistics of the European Pet Food Industry Association (FEDIAF), cats and dogs are the first and second pet breeds fed in Western Europe, and in 2022, cats and dogs accounted for a total of about 63.5% of the number of pets in the Western European pet market, which is dominant. In addition, European pet owners also like birds and fish as pets. By country, in Germany and France, the number of pet cats exceeds the number of pet dogs, while in the United Kingdom, the number of pet dogs is slightly better.

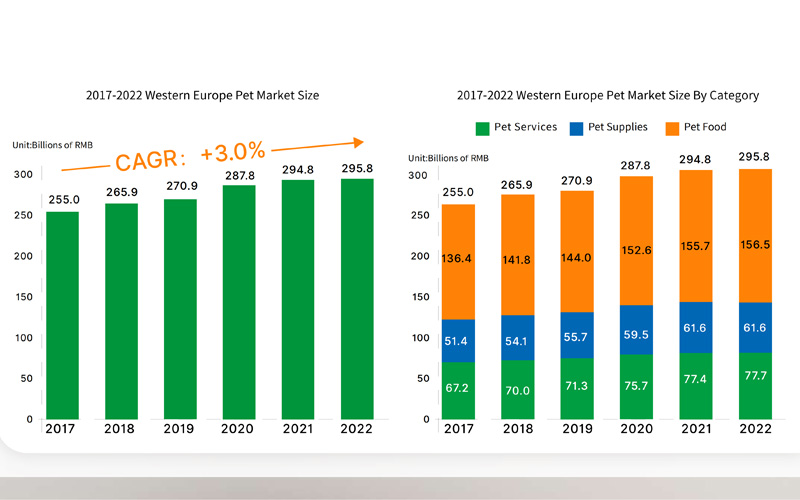

The pet market in Western Europe is relatively mature, except for the epidemic period. Due to the growth in demand for companionship and pet adoption, the number of pets remained stable for the rest of the year, and the development of the pet market is mainly driven by the high end of the various segments of the industry brought about by the enhancement of the unit price of the customer. From 2017 to 2022, the size of the pet market in Western Europe increased from RMB 255 billion to RMB 295.8 billion, with a compound annualized growth rate of 3.0%.

By category, the pet food market in Western Europe will account for the highest share of the pet food market in 2022, amounting to RMB156.5 billion, mainly due to the increasing focus of pet owners in Western Europe on the quality and safety of pet food, which is reflected in the growing number of "Human Grade" pet food products, i.e., pet food products meeting human food safety standards, in the pet food market in Western Europe. This is reflected in the increasing number of "human-grade" pet food products in the Western European pet food market, i.e., products that meet human safety standards. In addition, the pet supplies industry has seen the fastest market growth in the past five years, mainly driven by factors such as product intelligence and diversification, with the pet supplies market in Western Europe reaching RMB 61.6 billion in 2022.

Although the inflation rate in major Western European countries remains high, the deep emotional connection between humans and pets has led to an increase in the willingness of pet owners to provide their pets with the best nutrition. Plant-based, organic, and gluten-free have become popular categories in the Western European pet food market. A large number of startups have also emerged in this sector. For example, in the U.K. market, Omni, a plant-based dog food brand founded in 2020, has raised £1.1 million to boost its expansion plans. The brand's dog food is made from natural plant-based ingredients, such as pea protein, brown rice, oats, sweet potatoes, and pumpkin, and the company claims that 30% of the product's protein is higher than that of a standard meat-based dog food. The German market also saw vegan pet food startup Vegdog secure €3.5 million in funding.

Another noteworthy trend includes 'human grade,' or pet food that is of a grade that can be consumed by humans, which is also growing in popularity in Western European markets. Typically, human-grade pet food claims to use safer ingredients is less processed and is healthier than traditional pet food. The human-grade trend and the perception of pets as family members provide opportunities for innovation in higher value-added products, with human-grade brands such as Farmer's Dog, Terra Canis, and others gaining traction in Western Europe in recent years. Pet food brands such as Farmer's Dog and Terra Canis, which specialize in human-grade products, have gained popularity in Western Europe in recent years.

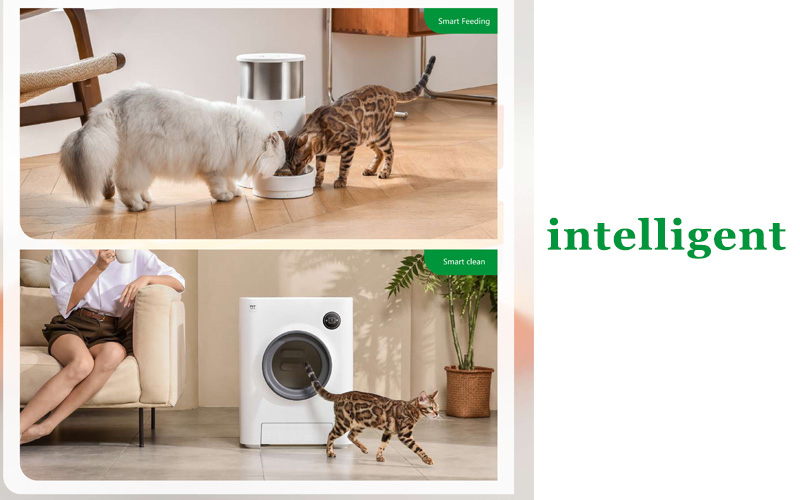

With the increase in the proportion of young pet owners and the promotion and education of head brands, the proportion of intelligent pet products in the Western European market has increased significantly. Smart deodorizers, for example, intelligent deodorizers, cat litter boxes that can monitor cat health, deodorize and self-clean automatically, bright pet drying boxes, and automatic watering bowls, have been widely accepted by consumers.

Consumer acceptance of pet technology products varies in different regions of Western Europe. According to market research done by Global PETS, French consumers are least interested in pet technology products, while British consumers are more receptive to them.

Pet supply brand owners in Western Europe are offering a lot of new supplies for pets and pet owners, such as pet wipes, which are wet for pets to use after going to the bathroom. Although this is a relatively new category, there are nearly 300 brands of pet wipes currently for sale on Amazon. In terms of search volume, "pet wipes" has doubled in the past few years.

Another emerging category is pet toothpaste. Oral hygiene products for pets, For instance, there are snacks available that contain certain ingredients that are helpful in maintaining good oral hygiene., have existed for a long time. The emergence of new products such as cat toothpaste allows owners to ensure that their pets' teeth and gums are in optimal condition, and brands such as Direct4Pet and Petrodex have even introduced chicken and fish flavors that are more palatable to pets.

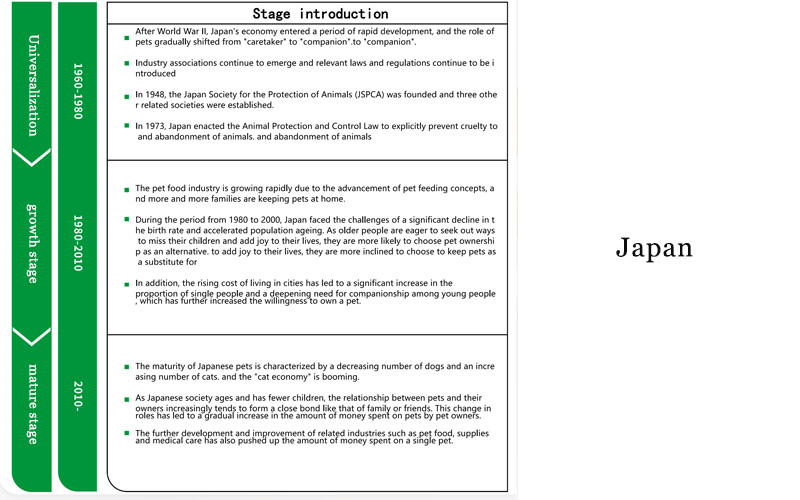

Japan's pet consumption rose after World War II, with the increase in the number of pets, the gradual formation of industry regulations, industry norms gradually improving, and the abundance of pet-related products and services increasing dramatically. The development of the Japanese pet industry after World War II is divided into three periods: the popularization period, the growth period, and the maturity period. From 1960 onwards, the number of pets in Japan proliferated due to the country's rapid economic growth. The number of registered dogs, for example, grew from less than 2 million in 1960 to a peak of about 7 million in 2009. Subsequently, the Japanese pet market gradually entered the maturity period, and due to the impact of time and money costs, Japanese pet owners' willingness to keep cats increased, and the number of dogs held from 2017 onwards decreased year by year.

The maturity of the Japanese pet market is characterized by a decreasing number of dogs, an increasing number of cats, and a booming "cat economy.".

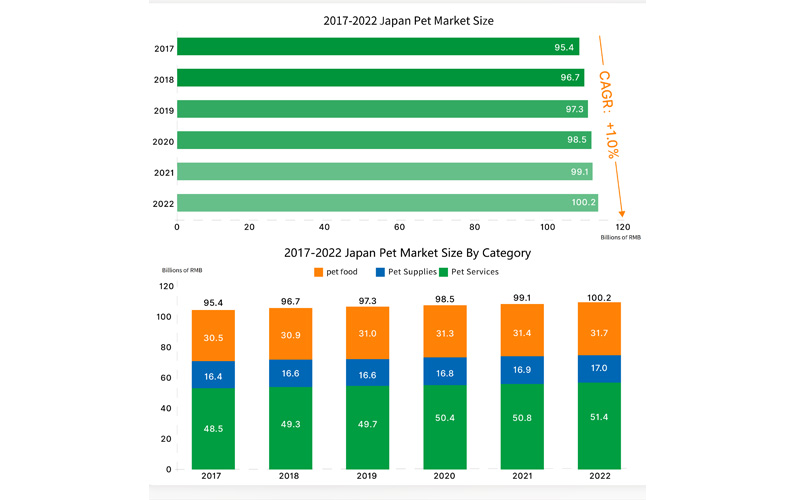

From size increasedJapan's pet market has entered the maturity stage, and the market size is relatively stable; from 2017 to 2022, Japan's pet market increased from 95.4 billion yuan to 100.2 billion yuan, a compound annualized growth rate of 1.0%.

By category, Japan's pet service market is highly developed. As one of the most developed and well-established regions in the global pet market, Japan's pet consumption industry chain is very mature. In addition to basic pet food, toys, and living supplies, pet services such as pet grooming, pet travel, pet medical care, and other subsectors are also very mature. In 2022, Japan's pet service market amounted to CNY 51.4 billion, the largest segment of the overall pet industry.

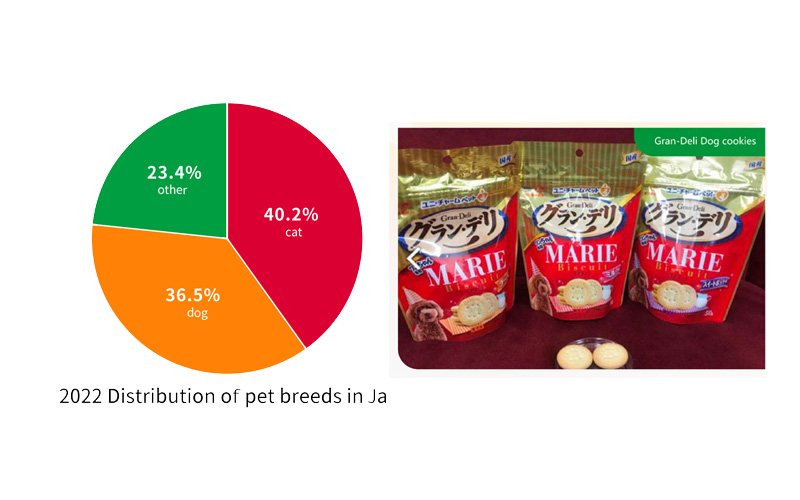

By the end of 2022, the number of pets in Japan had reached approximately 24.84 million, with the most common types of pets being cats and dogs, significantly smaller breeds. In 2022, 9.06 million pet dogs and 9.98 million pet cats were in the Japanese market. The number of cats and dogs exceeds the number of children aged 15 or younger.

Japanese pet owners are predominantly singles in their 20s and 30s, married couples without children, and older people who need companionship. Among them, older people mainly choose to own a pet to fulfill the need for emotional companionship. Due to the absence of their children, seniors feel the loneliness of life, and pets can be their faithful companions, providing companionship and support. According to third-party statistics, more than 60% of pets in Japan are owned by seniors over 50.

The share of pet cats in Japan's pet market continues to increase, which is mainly influenced by the following factors:

Influenced by historical factors: As early as the 8th and 12th centuries, cats became the pets of the Japanese noble class due to the scarcity of exotic species. Emperor Uda of Japan represented the early "cat slaves.". Since the 1980s, cats have appeared in many Totoro cartoon images, such as "Hello Kitty," Doraemon, and Totoro, in Japanese animation, film, and literature representing Japanese culture.

Japan's small housing area per capita makes it relatively suitable for cat breeding. Due to the country's situation, the housing area in Japan's cities and towns is generally tiny, and this phenomenon is more pronounced in large cities in particular. In general, canine keeping requires more space and barking, which is relatively unfriendly to pet owners living in cities. Overlaying this with an aging population and an increasing number of dual-income and single-person households all create disadvantages for dog owners.

Lower cost of owning a cat: According to Frost & Sullivan's research, pet owners in Japan spend an average of approximately RMB 4,100 per dog and RMB 2,900 per cat per year, making cats cheaper to own and boosting their appeal.

As more and more Japanese consider their pets part of the family, pet owners are diversifying their pet food needs. For example, according to a survey conducted by Unicharm Japan, more and more pet owners want their dogs to enjoy food close to the snacks their owners eat. To this end, Unicharm and Morinaga have collaborated to develop Gran-Deli Marie cookies for dogs, a cookie that adjusts the content of dairy ingredients so that dogs do not have digestive problems, and cookies that are the same shape and design as human Marie cookies, except that they are smaller in diameter and more convenient for dogs to eat.

As cats have a need for hydration from their food, the Japanese cat food market has developed a trend of switching from dry food to high-price-per-unit wet food and snacks as consumer spending power escalates. What sets the Japanese market apart is that Japan's geographic location makes it easy to obtain cat food ingredients. As a result, more and more pet owners are paying attention to the origins of their cat food ingredients. They are willing to pay extra for higher-quality local products, such as mackerel, herring, sardines, king mackerel, tuna, and skipjack tuna. Innovation in cat food ingredients in the Japanese market is reflected in ingredients other than seafood; for example, some brands also include other traditional herbal ingredients such as green tea, silver vine, and valerian, which is an alternative to catnip and a functional ingredient for dental health in cats, and valerian, which has anti-anxiety properties.

Additionally, due to the aging of pets in Japan, an increasing variety of pet foods is available. Veterinarians may recommend specific nutritional diets for treating diseases in dogs and cats by adjusting the amount and ratio of nutrients in the food, helping treat pet diseases such as kidney stones, urinary stones, diabetes, and skin disorders.

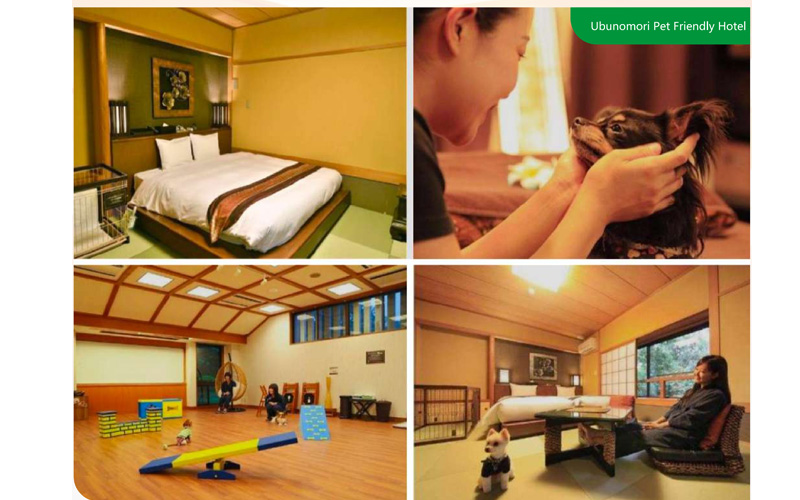

Japanese pet owners are more generous in their pet spending, and pet grooming services and pet training industries are very mature, and pet owners are very willing to invest in these programs. For example, in Japan, the price of a pet care session can be as high as 16,500 yen (about 780 RMB), a set of treatments that includes processes such as shampooing the dog with carbonated water, treatments, masks, and massages.

In Japan, pet owners are increasingly concerned about their pets' extended lifespans and health. According to a study by the Japan Pet Food Association, in 2022, the average life expectancy of pet cats in Japan will be 15.62 years (vs. 15.33 years in 2017), and the average life expectancy of dogs will be 14.76 years (vs. 14.19 years in 2017). The aging of dogs and cats has led to more health problems; for example, cancer is the most common cause of death in 10-year-old dogs, at about 23%, and chronic diseases such as heart disease and kidney disease are also on the rise.

Nationwide, the number of animal hospitals in Japan has risen yearly, with the number of hospitals now 18% higher than a decade ago, according to the Ministry of Agriculture, Forestry, and Fisheries. Diagnostic and treatment technology in Japanese pet hospitals is also highly developed, and in addition to medications, pet owners can use advanced diagnostic procedures such as surgery and MRIs.

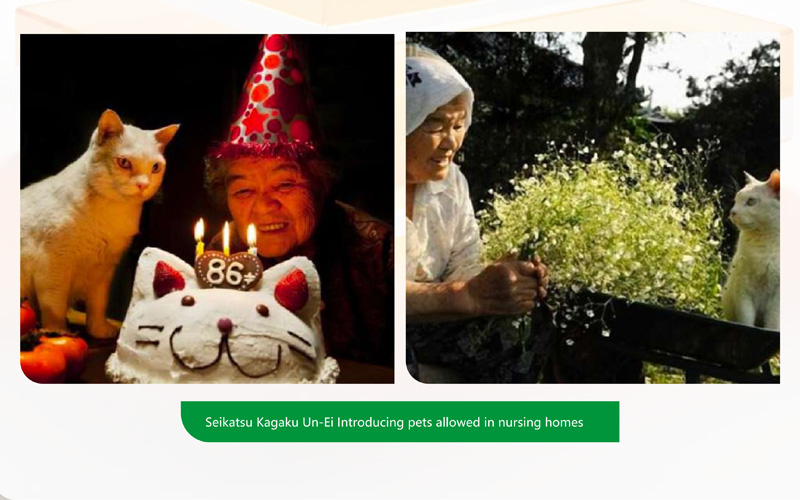

In addition, due to the aging of pet owners, more and more elderly pet owners are offering "guardianship" services for their dogs and cats in case the owners become incapacitated, need care, or pass away and cannot care for them. Some nursing homes are experimenting with new business models. One of them is Seikatsu Kagaku Un-Ei, a Tokyo-based company that operates nursing homes and apartments for older people and allows residents to live with their pets in 18 of its 27 facilities.

When we talk about pets, what are we talking about? Unconditional love, companionship, and loyalty. Pets, in these uncertain times, provide a certainty that we can hold on to. They make our lives more prosperous and meaningful, both purely and sincerely.

The development of society and people's emphasis on pet health is invariably urging the pet industry to upgrade and change. , incomparable. Whether it's pet food that pays more attention to natural, nutritious, and balanced ratios, or pet supplies that care for pets' lives by technological means, whether it's online communication or a return to offline interaction, every link of the pet industry is undergoing an incomparable, drastic, and radical change.

The world's leading pet intelligent life service provider, PuppyLulu, was founded in Ningbo, China, by a considerable R&D team with dedicated support that continues to design and launch pet-friendly products, pet toys, and pet users around the world to create trustworthy products and services to help pet owners have a timely understanding of their pet's health.

PuppyLulu, Devoted to independent innovation, research, and development since its inception, has launched a cumulative total of more than 500 product SKUs. The existing feeding, cleaning, care, outdoor, toys, and home six major product lines continue to create explosively hot-selling products, providing complete coverage of modern pet family supply needs.

Copyright ©2023 All Rights Reserved by Ningbo Makorn Pet Products Co., Ltd